About Lodging Tax

Guests who stay overnight in the Estes Park Local Marketing District pay a lodging tax on the total amount of their stay for all stays less than 30 days. The current lodging tax percentage collected is 2%.

The lodging tax funds the Local Marketing District (dba Visit Estes Park) for the purpose of promoting tourism in the Estes Park area in order to support our vibrant mountain town with a balance of business success, positive and memorable experiences for guests and a meaningful quality of life for our community.

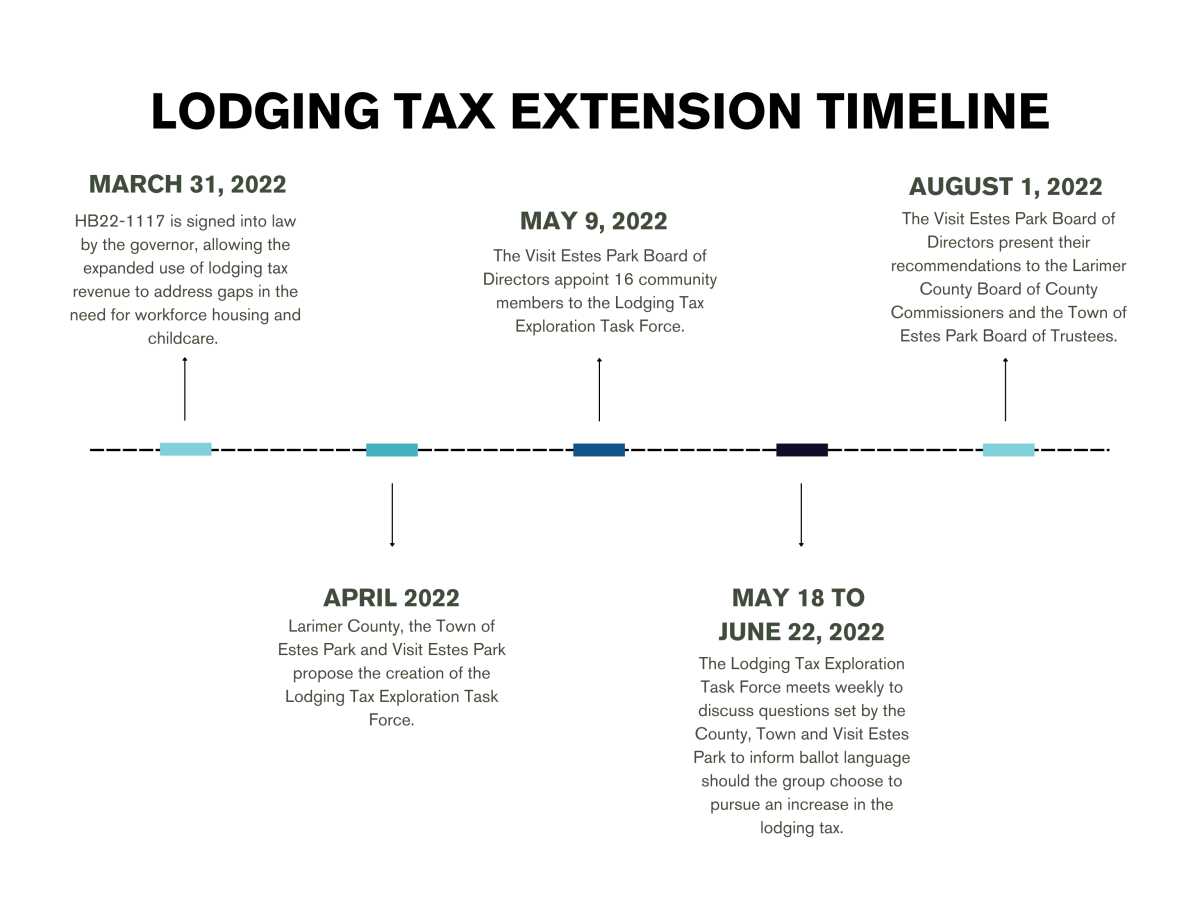

Lodging Tax Extension

A new law signed by Governor Polis expands the use of local lodging tax revenue to address gaps in the need for workforce housing and childcare.

For the legislation to be applicable to the local Estes Valley community, there must be a ballot initiative where voters decide if they should authorize the use of new or existing lodging tax revenue for investments in workforce housing and childcare. Larimer County, The Town of Estes Park and the Visit Estes Park Board of Directors are working together to put an initiative on the November 2022 ballot.

The Tax Extension will increase funding for workforce housing and childcare options in the Estes Valley, while preserving essential funds for tourism marketing. This ensures that we can maintain and grow the benefits that tourism brings to the valley, as well as a sustainable community ecosystem for local workers to live and prosper.

Lodging Tax FAQs

- Who can vote on the lodging tax extension? Residents of the Estes Park Local Marketing District are allowed to vote on this measure.

- Where is the Local Marketing District? The Local Marketing District is a region that includes Estes Park, Glenhaven and Drake. See the map.

- Who collects lodging tax? All lodging properties, including vacation rentals, in the Local Marketing District collect lodging tax from their guests.

- Who pays the lodging tax? Guests who stay overnight in Estes Park pay the lodging tax. Residents do not pay lodging tax.

- Who will pay the extended lodging tax? Like the current lodging tax, only guests who stay overnight in the Local Marketing District will pay any increase in lodging tax. Residents do not pay lodging tax.

- How have other similar communities in Colorado handled a similar tax extension? The average increased lodging taxes in 13 other Colorado communities is approximately 6 percent.

- What is the proposed tax increase in Estes Park? The Lodging Tax Exploration Task Force made a motion to increase the lodging tax from 2% to 5.5%, which would be an increase of 3.5 percentage points.

- How will the funds from the lodging tax extension be managed and implemented? The Town of Estes Park will implement and provide oversight of the funds. When a guest stays overnight, those funds are sent directly to the Colorado Department of Revenue. The money is then passed to Visit Estes Park because that is the mechanism for all lodging taxes collected. If the ballot measure passes, Visit Estes Park will send 3.5% of funds collected to the Town to be used only for workforce housing and childcare. Read the Draft of the Town of Estes Park's Proposed Framework for Expenditure of Potential Lodging Tax Revenues.